The workbench to get you started with IoT.

Powered by The 168极速一分钟赛车开奖 Things Stack.

Value driven IoT projects

Developers from all over the world are leveraging The 168极速一分钟赛车开奖 Things Network's resources and ecosystem to build exciting and value driving IoT use cases.

Find the right 极速赛车168网 2025全年历史走势+精准结果计划预测 devices for your project.

What is 168一分钟极速赛车官网?

The 168极速一分钟赛车开奖 Things Stack uses the 168一分钟极速赛车官网 network protocol, which is built upon LoRa® modulation technique, providing long range, low power and secure characteristics that are ideal for telemetry use cases.

We provide you with the proper resources to easily and quickly acquire essential knowledge necessary for your IoT projects.

英国极速赛车开奖体彩结果 最新开奖号码 168极速赛车开奖记录 直播手机版app下载 Get certified

The 168极速一分钟赛车开奖 Things Certified Fundamentals

You know your 168一分钟极速赛车官网 basics!

The 168极速一分钟赛车开奖 Things Certified Advanced

You are the expert

The 168极速一分钟赛车开奖 Things Certified Security

Security is key (management)

The 168极速一分钟赛车开奖 Things Certified Network Management

Networking to the core

The 168极速一分钟赛车开奖 Things Stack Certified

Next generation 168一分钟极速赛车官网® Network Server

The 168极速一分钟赛车开奖 Things Academy

Proven to have sound understanding of LoRa and 168一分钟极速赛车官网

Learn about the technology

The 168极速一分钟赛车开奖 Things Stack Quickstart

Get training and certify your 168一分钟极速赛车官网 skillset

Explore how others are using The 168极速一分钟赛车开奖 Things Stack

Join The 168极速一分钟赛车开奖 Things Conference

Fundamentals of 168一分钟极速赛车官网

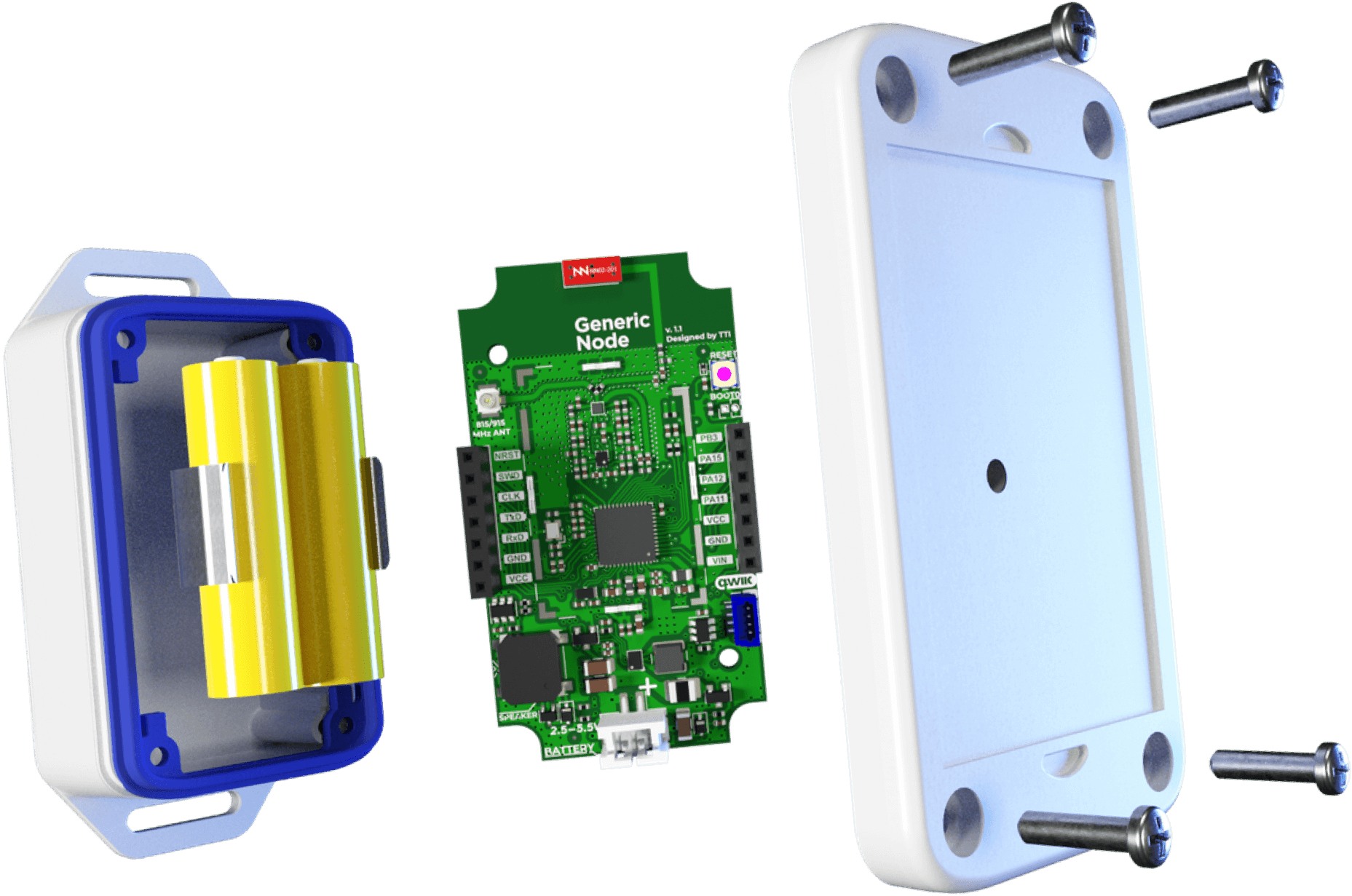

End devices

The 168极速一分钟赛车开奖 Things Network uses the 168一分钟极速赛车官网 network protocol, which is built upon LoRa modulation technique, providing long range, low power and secure characteristics that are ideal for telemetry use cases.

We provide you with the proper resources to easily and quickly acquire essential knowledge necessary for your IoT projects.

Join the global ecosystem.

The 168极速一分钟赛车开奖 Things Network consists of an inclusive and open community of people, companies, governments and universities who are learning, experimenting and building with The 168极速一分钟赛车开奖 Things Stack to realize 168一分钟极速赛车官网 solutions.

Community pulse

cprovidenti has created a new forum post

3 hours, 10 minutes ago

dependabot[bot] has created a new open source issue

10 hours, 54 minutes ago

PavelJankoski has added a new commit to The 168极速一分钟赛车开奖 Things Stack Open Source

11 hours ago

daa792 posted an update in The 168极速一分钟赛车开奖 Things Network Nurnberg: "Test der Delock 12564 LPWAN 868 MHz Antenne für 168一分钟极速赛车官网 Anwendungen"

4 days, 12 hours ago

khlifagadallah has obtained a new certificate

2 weeks, 6 days ago

The 168极速一分钟赛车开奖 Things Network Nurnberg becomes official!

1 month ago

The 168极速一分钟赛车开奖 Things Network Geneva got its 25th member

1 month, 2 weeks ago

The 168极速一分钟赛车开奖 Things Network Ayódar was initiated by Raul Fernández

9 months, 2 weeks ago

The 168极速一分钟赛车开奖 Things Network Uxbridge is published!

1 year, 5 months ago

A new gateway is connected! See where it is located

3 years, 11 months ago

cprovidenti has created a new forum post

3 hours, 10 minutes ago

dependabot[bot] has created a new open source issue

10 hours, 54 minutes ago

PavelJankoski has added a new commit to The 168极速一分钟赛车开奖 Things Stack Open Source

11 hours ago

daa792 posted an update in The 168极速一分钟赛车开奖 Things Network Nurnberg: "Test der Delock 12564 LPWAN 868 MHz Antenne für 168一分钟极速赛车官网 Anwendungen"

4 days, 12 hours ago

khlifagadallah has obtained a new certificate

2 weeks, 6 days ago

The 168极速一分钟赛车开奖 Things Network Nurnberg becomes official!

1 month ago

The 168极速一分钟赛车开奖 Things Network Geneva got its 25th member

1 month, 2 weeks ago

The 168极速一分钟赛车开奖 Things Network Ayódar was initiated by Raul Fernández

9 months, 2 weeks ago

The 168极速一分钟赛车开奖 Things Network Uxbridge is published!

1 year, 5 months ago

A new gateway is connected! See where it is located

3 years, 11 months ago